Property Insurance for Upholstery Cleaning

Let’s say you arrive at a client's home, ready to restore their furniture to pristine condition, only to realize your specialized cleaning equipment is damaged. For upholstery cleaning businesses, such unexpected mishaps can disrupt operations and strain finances.

Property insurance can help protect businesses like yours during such unpredictable events. By understanding how this coverage can help protect your valuable equipment and operations, you can focus on providing top-notch service instead of potential setbacks. Exploring insurance options can help you keep your business running smoothly, even if challenges arise.

Understanding Property Insurance for Upholstery Cleaning Businesses

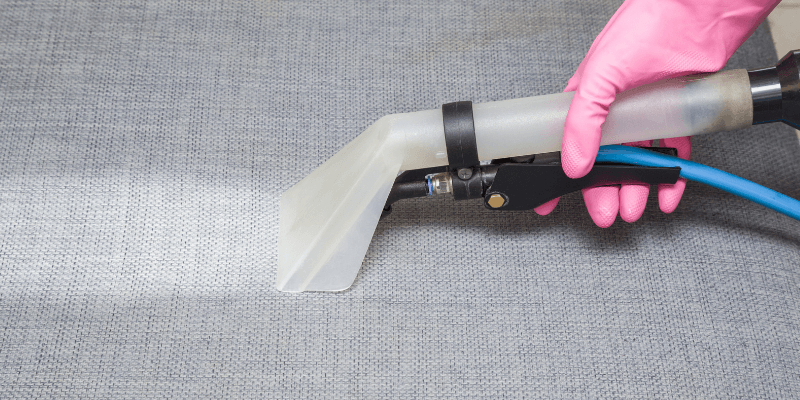

Property insurance is designed to help protect the physical assets of a business, offering coverage that can help offset the costs of damage or loss. For upholstery cleaning companies, this type of insurance can be particularly important since you likely rely heavily on specialized equipment. Plus, you may need to operate both in-house and at client locations.

Coverage typically includes protection for commercial property, such as cleaning machines, tools, and materials, meaning that you can replace or repair essential items without a significant financial burden. Property insurance may extend to cover damages that occur on-site at client properties, helping to provide an added layer of security for your business operations.

Common Risks in Upholstery Cleaning

Upholstery cleaning businesses may face a variety of risks that can disrupt their operations and affect their profitability. Some common risks include:

- Damage to specialized equipment: Without functional equipment, it can be difficult to deliver quality service to clients. It may not only be frustrating for you, but it can reflect poorly on your business. Property insurance for upholstery cleaning helps get your business back on track quickly and without breaking the bank on repairing or replacing equipment.

- Damage on business premises: If your cleaning business operates out of a dedicated space, damage to the premises—say, a storm—may affect your ability to operate. Property insurance can help cover the cost of repairs and replacements of damaged fixtures, equipment, or other items so that your business can get back up and running smoothly.

- Theft or vandalism: If someone were to rob you or damage your equipment, such incidents can result in the loss of expensive tools and materials. Instead of letting it affect your ability to operate, insurance coverage may be able to help get your equipment replaced for smooth operations once again.

By understanding these risks, business owners can appreciate the importance of property insurance in helping to mitigate potential financial setbacks.

Coverage Details for Upholstery Cleaners

To help protect your business from the unique risks it may face, there are several types of coverages that can support upholstery cleaning companies. Key coverage areas include:

- Business Property Coverage: This can offer protection for your equipment, tools, and materials within your business premises. If your cleaning machines, vacuums, or other specialized tools are damaged or stolen, your insurance policy can help cover the costs of repairs or replacement.

- Business Liability Coverage: Important for upholstery cleaning businesses, this coverage can protect against third-party claims for property damage or bodily injury that may occur during your operations. For example, if an accidental spill damages a client's expensive furniture, liability coverage can help manage the financial implications.

- Cyber Coverage: This coverage can help safeguard your business against the impacts of data breaches and cyber-attacks. Given the increasing reliance on digital tools for client management and transaction processing, helping to protect from the implications of cyber-attacks can be crucial.

Your concerns may start with property insurance, but that might not be the only type of coverage to consider. By choosing comprehensive insurance, upholstery cleaning business owners can be protected against a range of potential risks. With PolicySweet®, you can get BOP coverage, also known as a Business Owner Policy, which bundles these three insurance types into one convenient package. This way, you have coverage for multiple scenarios.

Highlights of Property Insurance for Upholstery Cleaning

Having property insurance can help provide upholstery cleaning businesses with:

- Achieving Peace of Mind: Knowing that your valuable equipment and tools can be protected against unexpected damage or theft may allow you to focus on delivering high-quality service to your clients.

- Operational Continuity: Property insurance can cover the costs of repairs or replacements, helping to minimize downtime and ensuring that your business can continue to operate smoothly.

- Maintaining a Healthy Reputation: Demonstrating a commitment to professionalism and responsibility through comprehensive insurance coverage can help make your business's reputation shine.

Overall, property insurance can help safeguard your business's financial stability and growth.

Securing Your Upholstery Cleaning Company

Property insurance can be helpful for cleaning businesses. It can allow you to be prepared for several risks and can give you the confidence to do your job with little stress if an accident occurs. By exploring coverage options that align with your specific needs, you can help safeguard your business assets and may be able to focus on providing exceptional service to your clients.

Get a quote today to help protect your business!